How Much Do I Get Paid on Workers’ Compensation?

For someone who has been hurt on the job, workers’ compensation wage loss benefits are critical. Wage loss benefits (also referred to as “indemnity” benefits) can be a household’s only source of income. Thus, it should come as no surprise that almost every client asks, “How much will I collect on workers’ comp?”

In Pennsylvania, an employee’s wage benefit is determined by the amount that he/she earned prior to the work injury. However, calculating a wage benefit is a two-step process.

First, we must determine the average weekly wage. An average weekly wage (AWW) is exactly what it sounds like: the average of the employee’s gross weekly earnings prior to the injury. For those who are paid with a set salary, you simply divide the annual salary by 52 weeks, and that provides your AWW.

For those who earn an hourly wage with fluctuating paychecks, it becomes a little more complex. In those cases, we have to break down the pre-injury wages into 13-week quarters. Then we calculate the average of the three highest quarters. That average becomes the employee’s AWW.

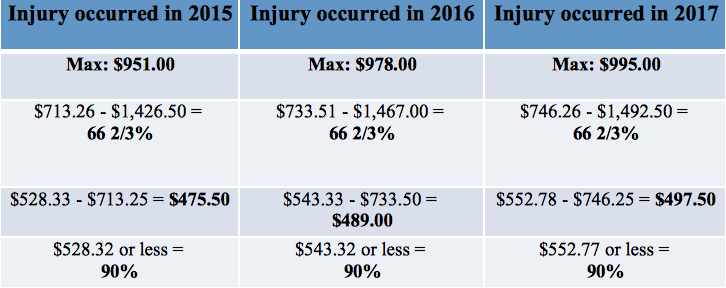

Unfortunately, the AWW is not what the employee will actually collect. After we determine the AWW, another calculation must be performed to determine the compensation rate. The following table provides the method of calculating the compensation rate. As you can see, the calculation is first controlled by the year in which you were injured. Each year, the Department of Labor and Industry determines the maximum amount that a person can collect on workers’ compensation, as well as the parameters for calculating the rate for the majority of workers who fall below that maximum.

As a side note, it is important to understand that you must to be disabled (i.e. out of work) for at least 7 days (consecutive or periodic) before you qualify for workers’ compensation wage loss benefits. Each day of disability after 7 days is payable; but once you reach 14 days of disability, all days of disability going back to day one are payable. For example, if you are disabled for 8 days, you get paid for one; however, if you reach 14 days of disability, all 14 days are payable.

Finally, it is also important to note that workers’ compensation disability payments are non-taxable. This means that the weekly checks are not taxed, and there is no 1099 form or need to declare any such payments on your annual taxes. This is because disability payments are not wages as far as the government is concerned.

If you are receiving workers’ compensation benefits and have questions about your compensation rate, you should speak to an attorney who specializes in workers’ compensation law. Call Gross Law Office today to schedule a free consultation.